Roth Capital Partners - Lion One Metals Coverage Report

InvestorSarfari Comments:

In this report, Roth capital rates Lion One metals a BUY with a price target of $2.50 twelve months out. In our opinion this target is on the lower end but understandably, it’s safer to lean towards a conservative target in this choppy market.

The report mentions the mining lease extension and the confidence it shows by the Fiji government, but the most important highlight is that Lion One now has joint venture or acquisition potential - a conclusion we previously outlined in the comments section of our last post HERE.

ROTH Capital Partners

Mike Niehuser, (949) 402-5336

mniehuser@roth.com

Sales (800) 933-6830, Trading (800) 933-6820

Resources: Metals & Mining

Lion One Metals Limited | LIO.V - C$1.24 - TSXV | Buy

LIO: Tuvatu Mining Lease Extension

LIO is developing, in our opinion, one of the highest-grade gold mines in the world. We believe that Tuvatu is competitive with Fiji’s Vatukoula (~7 to 11 million oz) gold mine, which has operated for over 85 years. Like Vatukoula, Tuvatu is an alkaline-epithermal gold deposit similar to Porgera (~16 to 35 million oz) and Cripple Creek (~24.6 million oz). The granting of the Tuvatu Mining Lease (SML 62) derisks the project, making it attractive to major mining companies.

Mining lease extended to 2035.

The Government of Fiji extended the 3.85 km2 Tuvatu Mining Lease (SML 62) an additional ten years, renewable on February 28, 2035. The granting of the original mining permit on Tuvatu to LIO indicated to us that Fiji was a mining-friendly jurisdiction. Having demonstrated further exploration, development and infrastructure, LIO earned the Government of Fiji’s confidence to grant a renewable ten-year extension.

In our opinion, the extension of time, with the potential to explore and develop the balance of the Navilawa caldera, elevates the potential of Tuvatu to equal Vatukoula and approach other alkaline gold systems.

Attractive for joint venture or acquisition.

LIO has successfully demonstrated the potential to extend the Tuvatu deposit at depth. This has resulted in the potential for Tuvatu to become a larger and higher-grade gold deposit than anticipated at the signing of the original mining lease. In addition, LIO has since expanded its exploration license over the Navilawa caldera, increasing the area under the prospecting licenses to ~136 km2. As alkaline gold systems may extend to great depths, and may branch near surface from a high-grade feeder, this underlies our opinion of Tuvatu’s growth potential to a profile that would be attractive to a major gold producer.

Drill results pending.

LIO has six active drill rigs and a fully-operational onsite assay laboratory. Given the number of active drill rigs and reduced turnaround time by the laboratory, we anticipate that LIO may release a significant number of drill results in the coming weeks. In our opinion, this should continue to demonstrate the expansion potential of the Tuvatu deposit consistent with our investment thesis.

VALUATION

The PEA estimated economics of a 1,000 tpd operation over a mine life of only five years at a base-case gold price of US$1,400. Under this scenario, the PEA calculated an after-tax NPV5% of US$121.7 million and an after-tax IRR of 50.9%. The after-tax NPV5% increases to US$202.8 million at an $1,800 gold price and US $243 million at a $2,000 gold price.

The PEA’s calculation was based on a five-year mine life, but stated that a seven- to ten-year mine life was likely. In our opinion, the gold price and shorter mine life used in the PEA show the resilient economics of the existing Tuvatu deposit, but do not realistically take into account LIO’s options for scaling production or further exploration potential at Tuvatu or the Navilawa Caldera. LIO is now in the process of completing its analysis on the appropriate scale to commence production at Tuvatu.

We have modeled several production scenarios. In our opinion, a modest-scale operation of 300 to 500 tpd over 10 years at a gold price of $1,800, with a 10% discount rate, may be valued at ~C$249 million, or ~C $1.60 per share. We anticipate that over the next 12 months, LIO has the potential to demonstrate a resource potential of two million ounces of gold at Tuvatu. This could support stepping up to 1,000 to 1,250 tpd over a mine life of 10 to 20 years. Our model shows a potential valuation of a larger facility resulting in a valuation of C$423 million, or ~C$2.50 per share.

In our opinion, as Tuvatu in the Navilawa Caldera has been identified as an alkaline gold system, it has the potential to grow into a multi-million oz gold resource. In addition, given the proximity, and numerous positive characteristics, LIO’s position in the Navilawa Caldera could match or better Vatukoula, with an 11 million oz deposit and an 85-year operating history. Beyond Tuvatu, given early exploration results within the Navilawa Caldera, we believe that there is the potential for an additional three to four Tuvatu-like prospects. We reiterate our price target of C$2.50 per share.

Factors that could impede LIO from achieving our price target include but are not limited to: inability to define additional resources, declining gold prices, development and construction challenges and inability to access additional capital and exploration risk.

RISKS

Political risk. Natural resource companies are subject to significant political risk. Although most mining jurisdictions have known laws, potential exists for these laws to change. Commodity price risk. All natural resource companies have some form of commodity price risk. This risk is not only related to final products, but can also be in regards to input costs and substitute goods. Operational and technical risk. Natural resources companies have significant operational and technical risks. Despite completing NI 43-101 compliant (or similar) resource estimates, deposits can still vary significantly compared to expectations. Additionally, numerous unforeseeable issues can occur with operations and exploration activities.

Pre-revenue risk. Pre-revenue natural resource companies are dependent on available cash, marketable assets and the ability to borrow or sell equity into capital markets to fund development including exploration and construction. There is no guarantee that the company will become cash flow positive.

Market risk. Although most natural resource companies are more closely tied to individual commodity price performance, large business cycle forces or economic crises can impact a company’s valuation significantly. Cautionary Note to US Investors: Estimates of Measured, Indicated and Inferred Resources “Measured Mineral Resources” and “Indicated Mineral Resources.” U.S. investors are advised that although these terms are required by Canadian regulations, the U.S. Securities and Exchange Commission (SEC) does not recognize them, and describes the equivalent as “Mineralized Material.” U.S. investors are cautioned not to assume that these terms are any form of guarantee.

“Inferred Mineral Resources.” U.S. Investors are advised that while this term is required by Canadian regulations, and the SEC does not recognize it. “Inferred Mineral Resources” are not delineated with a great deal of certainty and should not be considered likely to be brought into production in whole or in part.

COMPANY DESCRIPTION

LIO's primary asset is the 100% owned, fully permitted high grade Tuvatu Alkaline Gold Project, located on the island of Viti Levu in Fiji. LIO is developing a low-cost, high-grade underground gold mining operation at Tuvatu with exploration upside at depth and covering the entire Navilawa Caldera, alkaline gold system with a seven-kilometer strike across the caldera.

Regulation Analyst Certification ("Reg AC"): The research analyst primarily responsible for the content of this report certifies the following under Reg AC: I hereby certify that all views expressed in this report accurately reflect my personal views about the subject company or companies and its or their securities. I also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report.

Disclosures: Shares of Lion One Metals Limited may be subject to the Securities and Exchange Commission's Penny Stock Rules, which may set forth sales practice requirements for certain low-priced securities.

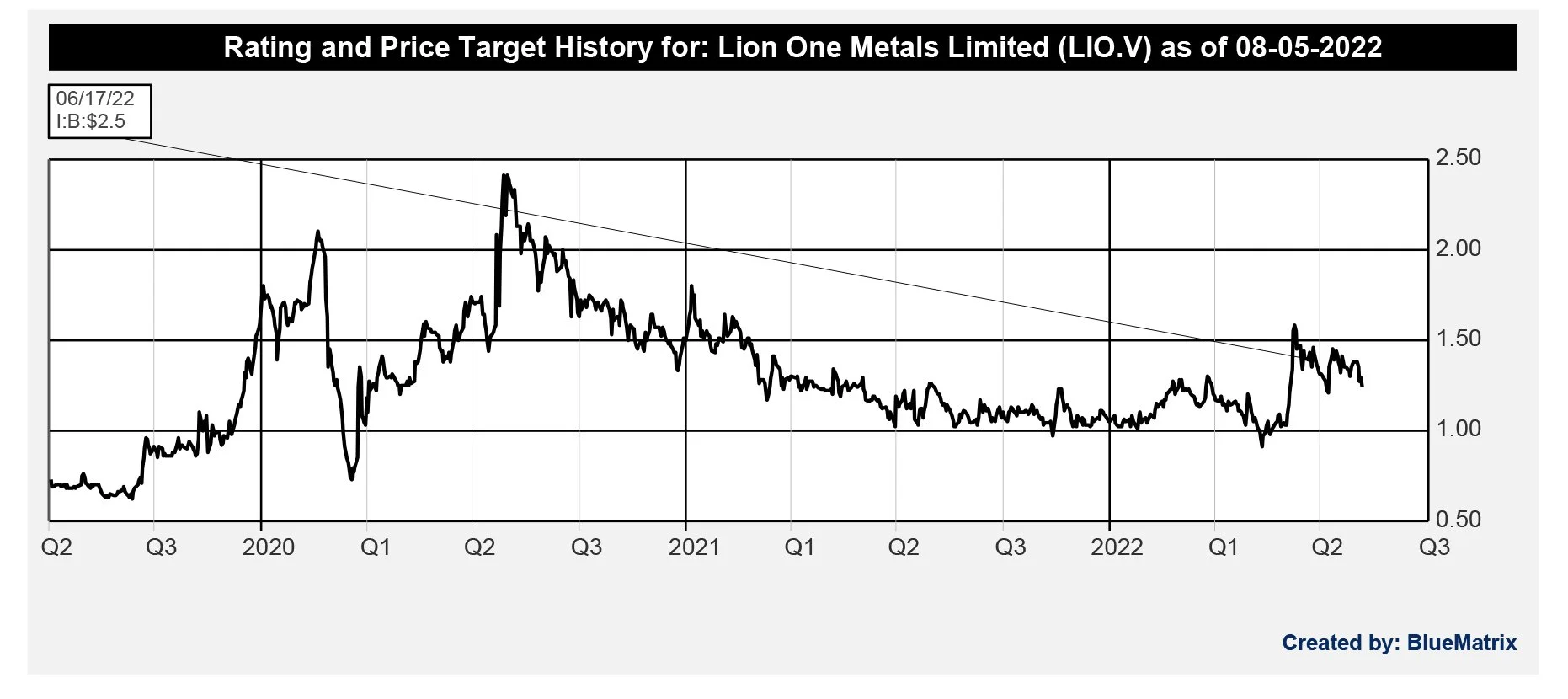

Each box on the Rating and Price Target History chart above represents a date on which an analyst made a change to a rating or price target, except for the first box, which may only represent the first note written during the past three years.

Distribution Ratings/IB Services shows the number of companies in each rating category from which Roth or an affiliate received compensation for investment banking services in the past 12 month.

Distribution of IB Services Firmwide

Our rating system attempts to incorporate industry, company and/or overall market risk and volatility. Consequently, at any given point in time, our investment rating on a stock and its implied price movement may not correspond to the stated 12- month price target.

Ratings System Definitions - ROTH employs a rating system based on the following:

Buy: A rating, which at the time it is instituted and or reiterated, that indicates an expectation of a total return of at least 10% over the next 12 months.

Neutral: A rating, which at the time it is instituted and or reiterated, that indicates an expectation of a total return between negative 10% and 10% over the next 12 months.

Sell: A rating, which at the time it is instituted and or reiterated, that indicates an expectation that the price will depreciate by more than 10% over the next 12 months.

Under Review [UR]: A rating, which at the time it is instituted and or reiterated, indicates the temporary removal of the prior rating, price target and estimates for the security. Prior rating, price target and estimates should no longer be relied upon for UR-rated securities.

Not Covered [NC]: ROTH does not publish research or have an opinion about this security.

ROTH Capital Partners, LLC expects to receive or intends to seek compensation for investment banking or other business relationships with the covered companies mentioned in this report in the next three months. The material, information and facts discussed in this report other than the information regarding ROTH Capital Partners, LLC and its affiliates, are from sources believed to be reliable, but are in no way guaranteed to be complete or accurate. This report should not be used as a complete analysis of the company, industry or security discussed in the report. Additional information is available upon request. This is not, however, an offer or solicitation of the securities discussed. Any opinions or estimates in this report are subject to change without notice. An investment in the stock may involve risks and uncertainties that could cause actual results to differ materially from the forward-looking statements. Additionally, an investment in the stock may involve a high degree of risk and may not be suitable for all investors. No part of this report may be reproduced in any form without the express written permission of ROTH. Copyright 2022. Member: FINRA/SIPC.

Click to read or standard download the full PDF report from MEGA here: